Services

Our Services

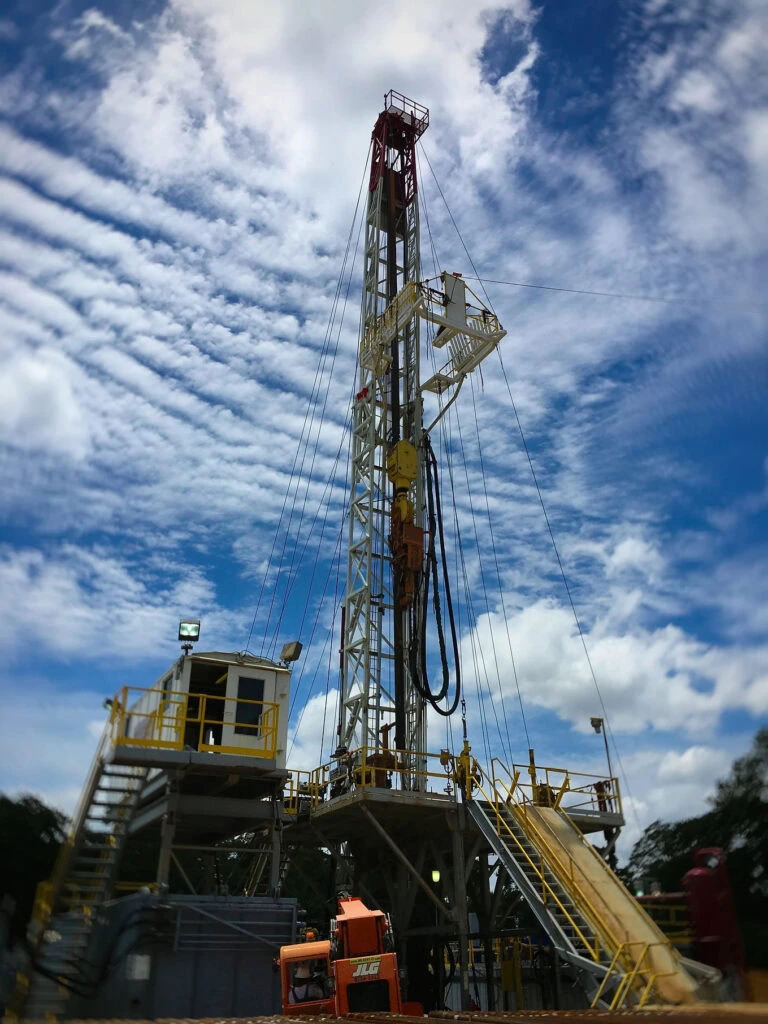

Domestic Drilling & Operating's Oil & Gas Technology

At Domestic Drilling and Operating, we are unwavering in our commitment to employing cutting-edge, sustainable infrastructure to execute our drilling projects. Our approach is rooted in the strict utilization of the latest horizontal drilling and modern fracturing techniques, which are at the forefront of technological advancements in the industry.

These innovative methodologies offer a multitude of advantages that not only enhance operational efficiency but also prioritize environmental stewardship. Horizontal drilling and modern fracturing techniques have the potential to lead to higher production rates, minimizing the need for excessive drilling and reducing the overall surface disturbance. Moreover, these practices contribute to increased economic efficiency, optimizing resource utilization and maximizing returns for our partners.

Perhaps most crucially, the adoption of these evolving technologies minimizes the risks associated with site hazards, promoting a safer working environment for our personnel and mitigating the potential impact on surrounding communities and ecosystems.

By embracing sustainable infrastructure and integrating the latest technological advancements into our operations, we at Domestic Drilling and Operating are committed to achieving the highest standards in every aspect of our industry. From responsible resource extraction to environmental conservation, we strive to strike a harmonious balance that benefits our partners, our nation’s energy security, and the planet we all share.

As we continue to navigate the ever-evolving landscape of the domestic oil and gas industry, our dedication to innovation, sustainability, and operational excellence will remain unwavering. We are confident that our approach will pave the way for a prosperous and secure energy future for generations to come.

Testimonials

Read What Real Investors Say about Domestic Drilling & Operating

Here are some reviews from our clients about our turnkey Oil and Gas Investment Opportunities and their outcomes.

4.9/5 Rating

Domestic Drilling & Operating News

Get The Latest From Our Oil and Gas News

Read and update the latest news from us, we have lots of the latest news about the oil and gas investing product.

Check out our other blog articles for recent news.