Asian nations now face steep tariffs of up to 36% on their exports to the United States, sparking an aggressive shift toward American oil and gas purchases. Indonesia stands at the forefront of this energy diplomacy strategy, offering a substantial $10 billion commitment to import U.S. oil and liquefied petroleum gas. Thailand has developed a parallel approach, structuring a 15-year agreement to secure 1 million metric tons of American LNG. The diplomatic energy rush extends further as India explores eliminating import taxes on U.S. natural gas, while Pakistan considers its first-ever American crude oil purchase. These calculated energy investments, coupled with the expansive $44 billion Alaska LNG project targeting key Japanese, South Korean, and Taiwanese buyers, demonstrate how Asian governments are leveraging energy trade to offset growing economic pressures from Washington. The rapid pivot toward American energy supplies represents a fundamental shift in regional trade patterns that could reshape traditional energy alliances across Asia.

Asian Nations Offer Energy Deals to Avoid Tariffs

Several Asian nations have launched aggressive energy acquisition strategies with the United States, hoping to minimize threatened tariffs on their exports. These calculated offers aim to reduce trade surpluses with America by substantially increasing purchases of U.S. oil and gas products.

Indonesia pledges $10B in U.S. energy imports

Indonesia has proposed a major increase in crude oil and liquefied petroleum gas (LPG) imports from the United States, valued at approximately $10 billion. This forms part of Indonesia’s broader strategy to boost American purchases by $18-19 billion. Energy Minister Bahlil Lahadalia unveiled these plans as Indonesian officials prepared for critical trade discussions in Washington.

The Southeast Asian nation currently faces potential 32% tariffs on its exports to the United States. To accommodate increased American imports, Indonesia must substantially restructure its current energy supply chain, potentially reducing LPG imports from Middle Eastern suppliers by 20-30%.

Current market data reveals Indonesia imports 217,000 barrels per day (bpd) of LPG, with about 124,000 bpd already sourced from the U.S. For crude oil, the nation imports 306,000 bpd primarily from Nigeria, Saudi Arabia, and Angola, with only 13,000 bpd currently coming from America.

India considers LNG tax cuts to boost purchases

India has begun exploring the elimination of import taxes on U.S. liquefied natural gas to increase purchases and address its trade surplus with Washington. The country currently applies a 2.5% basic customs duty plus an additional 0.25% social welfare tax on LNG imports.

In addition to LNG tax cuts, India plans to:

- End taxes on U.S. ethane imports

- Remove duties on U.S. liquefied petroleum gas

- Increase overall energy purchases from America

During Prime Minister Narendra Modi’s recent U.S. visit, India pledged to increase U.S. energy purchases from $15 billion to $25 billion in the near future. Furthermore, both nations agreed to target $500 billion in bilateral trade by 2030.

India’s oil ministry has directed companies to raise energy imports wherever possible. As part of this initiative, GAIL India, the country’s largest LNG importer, is tendering for up to a 26% stake in a U.S.-based LNG project alongside a 15-year purchase agreement.

Thailand and Pakistan join energy diplomacy push

Thailand has developed a strategic energy import plan to avoid high tariffs on its exported goods. The Thai government has committed to import over 1 million metric tons per year of U.S. LNG for the next five years as part of a 15-year plan starting in 2026. Additionally, Thailand will purchase 400,000 tons of U.S. ethane over four years, valued at $100 million.

The U.S.-Thailand Energy Policy Dialog provides the framework for bilateral cooperation on energy security and reciprocal investments. Through this established channel, Thailand has secured long-term contracts with American companies for LNG supplies.

Pakistan, confronting similar trade pressures, is actively considering importing U.S. crude oil for the first time. According to government and industry sources, Pakistan aims to match its current fossil fuel imports by value, potentially bringing in approximately $1 billion worth of American oil.

South Korea has also entered negotiations, planning to leverage its shipbuilding capabilities alongside commitments to purchase more U.S. LNG in upcoming tariff talks. The country’s Foreign Minister Cho Tae-yul confirmed these discussions are expected to begin next week.

As a result of these coordinated efforts, U.S. energy exporters stand to benefit substantially from this new wave of Asian energy diplomacy, which represents a significant shift in regional trade patterns and energy security strategies.

Trump Administration Uses Tariffs to Reshape Trade

President Trump has strategically deployed tariffs as a powerful tool to restructure global trade relationships, creating substantial leverage for negotiating more favorable terms with trading partners. This approach has pushed numerous nations toward energy deals as they seek solutions to reduce their trade surpluses with the United States.

Tariffs paused for 90 days amid negotiations

After several days of market volatility, President Trump announced an unexpected 90-day pause on newly imposed “reciprocal” tariffs on April 9, reducing rates to 10% for most countries [10]. This decision came just hours after higher country-specific tariffs had taken effect [11]. The pause notably excludes China, which now faces tariffs up to 245% after implementing retaliatory measures against U.S. actions [1].

“More than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution,” Trump stated when announcing the pause [10]. Treasury Secretary Scott Bessent described these upcoming negotiations as “bespoke,” indicating individualized arrangements with each country [2].

This temporary reprieve provides the administration until early July to secure bilateral agreements with dozens of nations [11]. Countries that had refrained from retaliatory measures against initial U.S. tariffs received this relief, with the White House showing preference toward allies:

- Japan (facing potential 24% tariffs without a deal) [12]

- South Korea (facing potential 25% tariffs) [12]

- European Union (facing potential 20% tariffs) [12]

Despite the pause, baseline tariffs of 10% remain in effect on most imports, alongside 25% tariffs on steel and 25% on aluminum [1]. The European Union responded by suspending its own retaliatory measures for 90 days following Trump’s announcement [11].

Energy trade used to reduce U.S. trade deficits

The administration has directly connected energy exports to its trade deficit reduction strategy. President Trump demanded the European Union purchase $350 billion of American energy products to eliminate its trade surplus with the United States, which reached $235.6 billion in 2024 [12].

Energy presents a logical focus for these negotiations since the United States has maintained its position as a net energy exporter since 2019 [3]. The sector represented approximately 15% of total U.S. exports in 2024 [12], with natural gas exports hitting record levels in 2023 [3].

“Energy will play a key role in those negotiations,” noted industry analysts, highlighting the administration’s view of oil and gas exports as “a key mechanism for reducing trade gaps” [4]. Liquefied natural gas (LNG) has emerged as the primary commodity where countries can significantly increase American imports [12].

However, energy purchases alone cannot completely resolve trade imbalances. Even substantial commitments to buy U.S. energy will “not necessarily spare any buyer from tariffs” [5], as demonstrated by Taiwan’s experience. Despite major investments in U.S. energy projects, Taiwan initially faced a 32% tariff that has since been temporarily suspended [5].

The administration’s approach carries particular implications for Canada, which received special consideration with a lower 10% tariff on energy exports compared to the 25% applied to its other goods [13]. This distinction recognizes the interconnected nature of North American energy markets and U.S. dependence on Canadian supplies.

For U.S. oil and gas companies, the strategy creates significant opportunities as countries seek to avoid higher tariffs through energy purchases. Conversely, the energy sector faces unique challenges from broader tariff policies, since “applying them to energy brings a unique set of challenges” [13] due to the highly interconnected nature of global energy supply chains.

Taiwan’s Alaska LNG Investment Fails to Prevent Tariffs

Taiwan chose a markedly different path than other Asian nations, making early investments in American energy infrastructure rather than simply promising increased purchases. This forward-looking approach, however, initially failed to shield the island from steep U.S. tariffs.

CPC Corp signs $44B Alaska LNG deal

Taiwan’s state-owned CPC Corporation formalized a major investment in Alaska’s liquefied natural gas project in 2017, well before the current trade tensions began. The agreement involved a massive $44 billion commitment to the Alaska LNG project, establishing one of the largest energy investments by an Asian nation on American soil.

The project encompasses three critical components:

- A gas treatment plant on Alaska’s North Slope

- An 800-mile pipeline across Alaska

- A liquefaction facility in Nikiski for export to Asian markets

When completed, the Alaska LNG project will deliver approximately 2 million tons of liquefied natural gas annually to Taiwan over a 20-year period. CPC’s early commitment represented a strategic move to strengthen energy ties with the United States while securing a stable long-term natural gas supply for Taiwan’s growing economy.

Taiwan still hit with 32% tariff despite early commitment

Despite Taiwan’s substantial investment in American energy infrastructure, the island economy found itself included in President Trump’s tariff announcement with a steep 32% duty on its exports to the United States. This rate matched those applied to other major Asian exporters, seemingly disregarding Taiwan’s significant energy commitments.

The decision shocked Taiwanese officials who had believed their early and substantial energy investments would earn preferential treatment. Unlike other Asian nations now scrambling to arrange energy purchases in response to tariff threats, Taiwan had already demonstrated long-term commitment to American energy projects.

Taiwan’s experience shows that even major investments in U.S. energy infrastructure provide no automatic shield from trade penalties. The case highlights the administration’s determination to use tariffs as leverage regardless of existing energy relationships or prior commitments.

Taiwan did receive partial relief when the 90-day tariff pause was announced. The temporary reduction to 10% provides Taiwanese officials critical time to negotiate additional terms, likely including further commitments to American oil and gas purchases beyond their existing Alaska LNG arrangement.

The situation underscores the complex relationship between energy investments and trade policy in the current climate, where even long-standing energy partners must engage in tough negotiations to secure tariff exemptions. Taiwan’s experience serves as a cautionary tale for other Asian nations rushing to finalize energy deals with Washington.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

How Energy Diplomacy is Redrawing Global Alliances

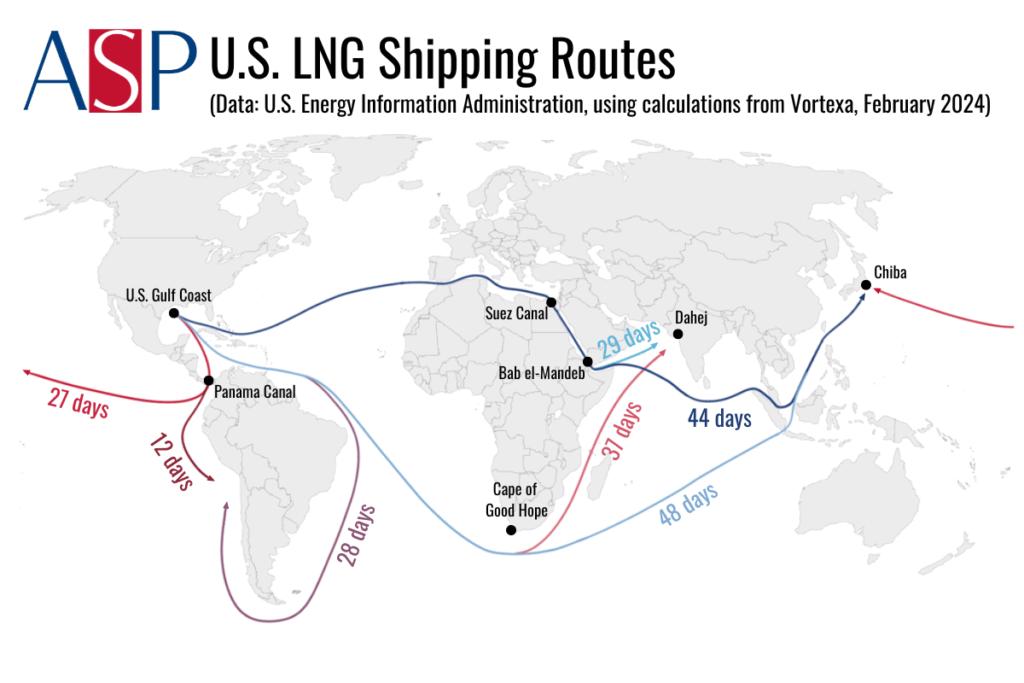

Image Source: American Security Project

Energy alliances across Asia are undergoing dramatic shifts as major economies pivot toward American oil and gas supplies. The United States has established itself as a global energy superpower, generating unprecedented diplomatic leverage that reshapes traditional partnerships throughout the region.

Japan and South Korea weigh Alaska LNG participation

Japan’s potential involvement in the $44 billion Alaska LNG project stands as a cornerstone of evolving U.S.-Asia energy relations. Treasury Secretary Scott Bessent specifically highlighted this project as a strategic opportunity that “could narrow the U.S. trade deficit” with Japan [14]. During recent discussions, Japanese Prime Minister Shigeru Ishiba voiced optimism regarding Japan’s participation in this massive development [15].

South Korea has similarly expressed interest in the Alaska venture as a strategic response to tariff pressures. Industry Minister Ahn Duk-geun conveyed South Korea’s readiness to collaborate during talks with U.S. officials [7]. President Trump later confirmed a conversation with South Korea’s acting President Han Duck-soo, which addressed “their joint venture in an Alaska pipeline” alongside other critical matters [14].

Significant financial obstacles remain, however. Korea Gas Corporation (Kogas) confronts financial limitations after “years of supplying gas below cost” [8], potentially restricting its capacity for substantial investments. Consequently, industry experts suggest that “Korea should consider partnering with countries like Japan or Taiwan to share the risks” should the project move forward [8].

Geopolitical implications of U.S.-Asia energy ties

The strategic realignment of energy trade creates profound geopolitical effects across multiple dimensions:

- Middle East displacement: East Asian economies have historically relied on Middle Eastern suppliers for the vast majority of their energy—95% of Japan’s crude oil, 72% of South Korea’s, and 69% of Taiwan’s came from GCC nations in 2023 [16].

- Security enhancement: By tying their energy security directly to “the nation with the world’s strongest military,” East Asian democracies can “significantly bolster deterrence against potential PRC aggression” [17].

- Russian influence reduction: Expanded U.S. LNG purchases would help Asian allies “reduce reliance on Russian gas” [15], with Japan, South Korea, and Taiwan currently importing nearly 8 million metric tons annually from Russia [17].

America’s emergence as an energy superpower thus creates substantial leverage for reshaping trade relationships and strengthening security partnerships with key Asian allies, marking a fundamental power shift across the region. The energy-based realignment extends beyond mere commercial considerations, establishing new security frameworks that could define Pacific relationships for decades to come.

What This Means for U.S. Energy Policy and Exports

The surge of energy deals from Asian nations comes at a critical juncture for U.S. oil and gas exporters. These diplomatic initiatives align perfectly with an unprecedented expansion in American energy export capabilities, creating both remarkable opportunities and significant challenges for domestic markets.

Boost for U.S. LNG and crude oil exporters

U.S. liquefied natural gas exports now represent the largest source of natural gas demand growth, projected to increase by 19% to 14.2 billion cubic feet per day (Bcf/d) in 2025 and by 15% to 16.4 Bcf/d in 2026 [18]. This substantial growth stems from three major new facilities coming online:

- Plaquemines LNG (Phases 1 and 2)

- Corpus Christi LNG Stage 3

- Golden Pass LNG

Together, these facilities add 5.3 Bcf/d of nominal export capacity, expanding existing U.S. LNG export capability by almost 50% [18]. The United States currently holds position as the world’s largest oil producer, averaging 12.3 million barrels daily in 2023 [19], while simultaneously becoming the largest global exporter of natural gas [19].

The Asian energy deals primarily target American LNG, perfectly complementing industry projections that five major export terminals under construction on the Gulf Coast could potentially double the nation’s LNG capacity by 2027 [9]. U.S. LNG exports already reached a record 8.6 million metric tons in December 2023 [9], demonstrating the sector’s robust growth trajectory.

Potential strain on domestic supply and infrastructure

While beneficial for exporters, this rapid expansion creates meaningful domestic pressures. A Department of Energy study estimates that a 32.6 Bcf/d increase in LNG exports—approximately 30% of U.S. gas supply—would raise domestic wholesale prices from $3.53 to $4.62/MMBtu, a 31% increase [6].

Infrastructure limitations present another significant challenge. Even as supply grows, “midstream capacity may be the biggest risk to supply growth and low prices” [20]. Transporting natural gas to export terminals requires substantial pipeline development, with each 1 Bcf/d of new LNG export capacity requiring approximately $4.5 billion in capital investment [21].

The export boom simultaneously affects domestic consumption patterns. Higher gas prices resulting from expanding LNG exports will reduce U.S. natural gas consumption, particularly in the power sector [6]. Achieving balance between export growth and domestic needs depends heavily on policies enabling faster investment in regional and inter-regional transmission infrastructure [20].

These Asian energy deals ultimately accelerate an ongoing transformation of American energy markets from primarily domestic focus toward increasingly global orientation, where “every incremental barrel of oil or cubic foot of gas is now likely to be exported” [19]. The shift creates a new reality for U.S. energy policy, requiring careful management of both international opportunities and domestic market stability.

Domestic is the best operating oil and gas exploration company located in the Dallas, TX

Interested In Working With Domestic operating?

Our News and Blog articles we write are here to keep you up to date in the Oil and Gas Industry

Conclusion

Trade tensions between the United States and Asian nations have triggered dramatic shifts in global energy markets unlike anything seen in recent decades. Asian countries now view American oil and gas purchases as their primary shield against steep tariffs, resulting in landmark agreements such as Indonesia’s $10 billion energy import commitment and Thailand’s comprehensive 15-year LNG deal. These strategic energy partnerships function not merely as trade transactions but as geopolitical realignments, fundamentally altering traditional alliances and reducing Asia’s historic dependence on Middle Eastern suppliers.

The wave of Asian energy deals coincides perfectly with America’s expanding export capabilities, though substantial hurdles must be overcome. Can U.S. LNG facilities successfully double their capacity by 2027 to satisfy this surging demand? Domestic markets will likely face upward price pressures and infrastructure constraints as exports accelerate. Taiwan’s experience serves as a cautionary tale—energy investments alone provide no guaranteed tariff protection. Yet the broader pivot toward American energy continues to reshape international trade patterns like a powerful tide reshaping a coastline.

The implications extend far beyond balance sheets and trade statistics. Asian nations strengthen their security partnerships with the U.S. while simultaneously reducing dependence on Russian gas and Middle Eastern oil. This energy-driven diplomacy represents a fundamental power shift in global markets, establishing American oil and gas exports as essential instruments in international trade negotiations and strategic alliances. What began as trade tension has evolved into a comprehensive realignment of energy relationships that will define regional dynamics for years to come.

What are Asian countries offering to avoid U.S. tariffs?

Several Asian nations are proposing massive energy deals, including increased purchases of U.S. oil and liquefied natural gas (LNG), to ease trade tensions and avoid steep tariffs on their exports to the United States.

How is Indonesia responding to potential U.S. tariffs?

Indonesia has pledged to increase its imports of U.S. crude oil and liquefied petroleum gas by approximately $10 billion, as part of a broader commitment to boost U.S. purchases by $18-19 billion to avoid potential 32% tariffs on its exports.

What role does the Alaska LNG project play in U.S.-Asia energy relations?

The $44 billion Alaska LNG project has become a focal point in U.S.-Asia energy diplomacy, with Taiwan already committed and Japan and South Korea considering participation. This project could significantly reduce U.S. trade deficits with these countries.

How are U.S. energy exports affecting global alliances?

The surge in U.S. energy exports is reshaping traditional alliances, particularly in Asia. Countries are reducing their dependence on Middle Eastern and Russian energy supplies by increasing purchases from the U.S., which also strengthens their security ties with America.

What challenges does the U.S. face in meeting increased energy export demands?

While beneficial for exporters, the rapid expansion of U.S. energy exports creates domestic pressures, including potential increases in wholesale gas prices and strain on infrastructure. Balancing export growth with domestic needs will require significant investment in pipeline and transmission infrastructure.